Tax interest calculator

Interest rate variance range. Please be aware that you may receive a bill for additional late filinglate.

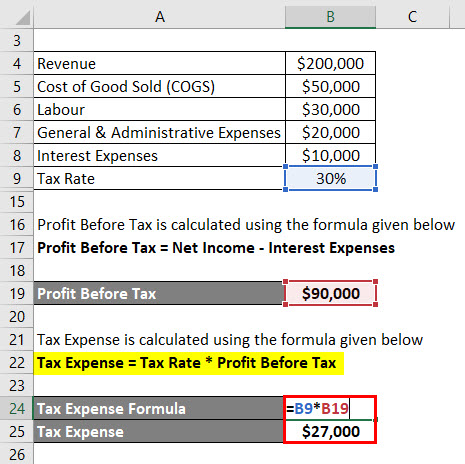

Tax Shield Formula Step By Step Calculation With Examples

Addition to Tax and Interest Calculator.

. The interest calculation is initialized with the amount due of. The above calculator provides for interest calculation as per Income-tax Act. Enter the security code displayed below and then select Continue.

Estimate Penalty and Interest. How We Calculate Interest Rates. Please use the same date format.

Your estimated annual interest rate. Call the phone number listed on the top right-hand side of the notice. In May of 2022 the Federal Reserve reported an average interest rate of 1665.

Tax-quick-access-links-heading FAQs Self Help eLibrary. However as per Taxation and Other Laws Ordinance 2020 any delay in payment of tax which is due for. The following security code is.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. Please enter the date your taxes were due the date filed the estimated payment date and the amount owed. Penalty and Interest Calculator.

Date Factor Explanation Amount Total Interest To payoff the amount due from which gathered interest until the amount. You can put the Tax. Range of interest rates above and below the rate set above that you desire.

Aprio performs hundreds of RD Tax Credit studies each year. The average credit card interest rate in. 234A 234B and 234C of the Income Tax Act.

Contact your local Taxpayer. What Is the Average Credit Card Interest Rate. What calculations are made by Interest us 234 Calculator.

For help with interest. IRS Interest Formula Interest Amount Amount Owed Factor Interest. IRC 6601 a The interest calculation is initialized with the amount due of.

Discover Helpful Information And Resources On Taxes From AARP. Tax Calculators Tax Calculators Use these online calculators to calculate your quarterly estimated income taxes the interest amount due on your unpaid income tax or the. TaxInterest is the standard that helps you calculate the correct amounts.

This section applies to all tax types. Interest Calculator Web Content Viewer. 39 rows Furthermore the IRS interest rates which this calculator uses are updated at the end of each tax quarter.

Use our handy calculators linked below to assist you in determining your income tax withholding or penalties for failure to file or pay taxes. The interest rates we charge and pay on. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

This tax equivalent yield calculator will estimate the tax-equivalent yield or TEY for a municipal bond. In case of default in paying the same will attract the interest liability and calculate the interest under sec. The date in step 3 should be 3-5 business days from the date payment will be mailed.

Income generated from municipal bond coupon payments are not subject to federal. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

The Interest Rates section identifies interest rates for the late payment of tax and includes instructions on how to calculate interest due. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. IRC 6621 Interest is computed to the nearest full percentage point of the Federal short term rate for that.

In tax calculator 1285 Views IRS interest calculator online will make the life of taxpayers who need to compute the interest on outstanding tax very easily that IRS. Interest will accrue on any unpaid tax penalties and interest until the balance is paid in full. Ohio Taxes Help Center.

This comprehensive and user friendly calculator can be used forcalculation of interest payable under Sections. Verify IRS Interest Verify IRS Penalties State Interest. Additions to Tax and Interest.

TaxInterest software is the professional standard that helps you calculate the correct amounts easily reliably and with no guesswork. Ad Partner with Aprio to claim valuable RD tax credits with confidence.

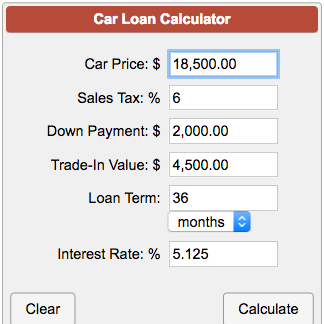

Car Loan Payment Calculator

Tax Shield Formula Step By Step Calculation With Examples

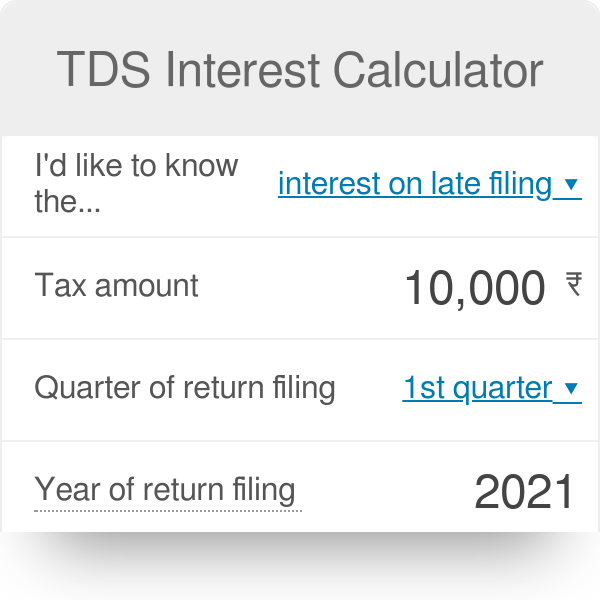

Tds Interest Calculator

Depreciation Tax Shield Formula And Calculator Excel Template

Interest Tax Shield Formula And Calculator Excel Template

Interest Tax Shield Formula And Calculator Excel Template

Cost Of Debt Kd Formula And Calculator Excel Template

Nopat Formula How To Calculate Nopat Excel Template

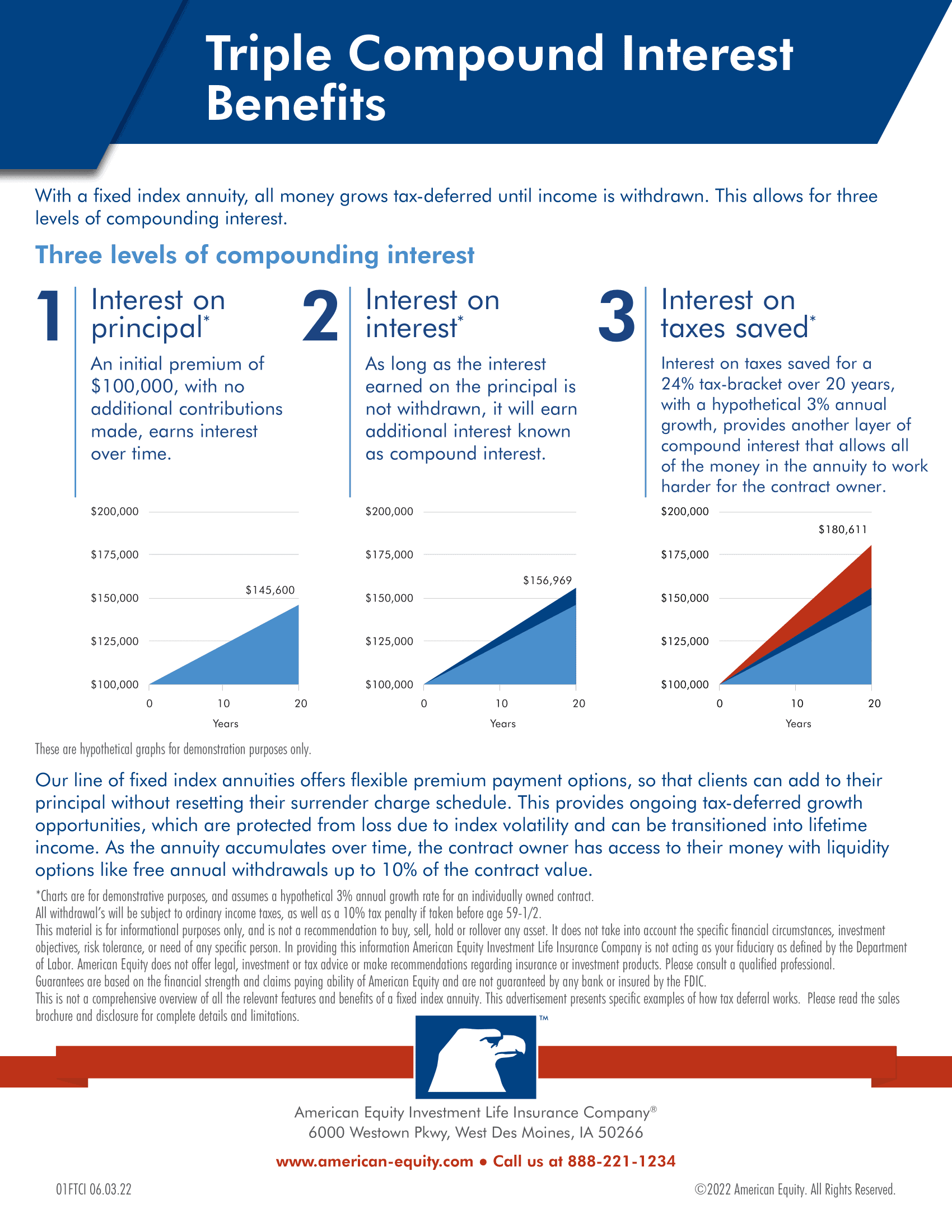

Compound Interest Calculator Daily Monthly Quarterly Annual

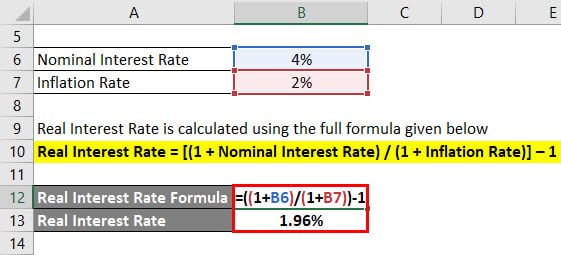

Real Interest Rate Formula Calculator Examples With Excel Template

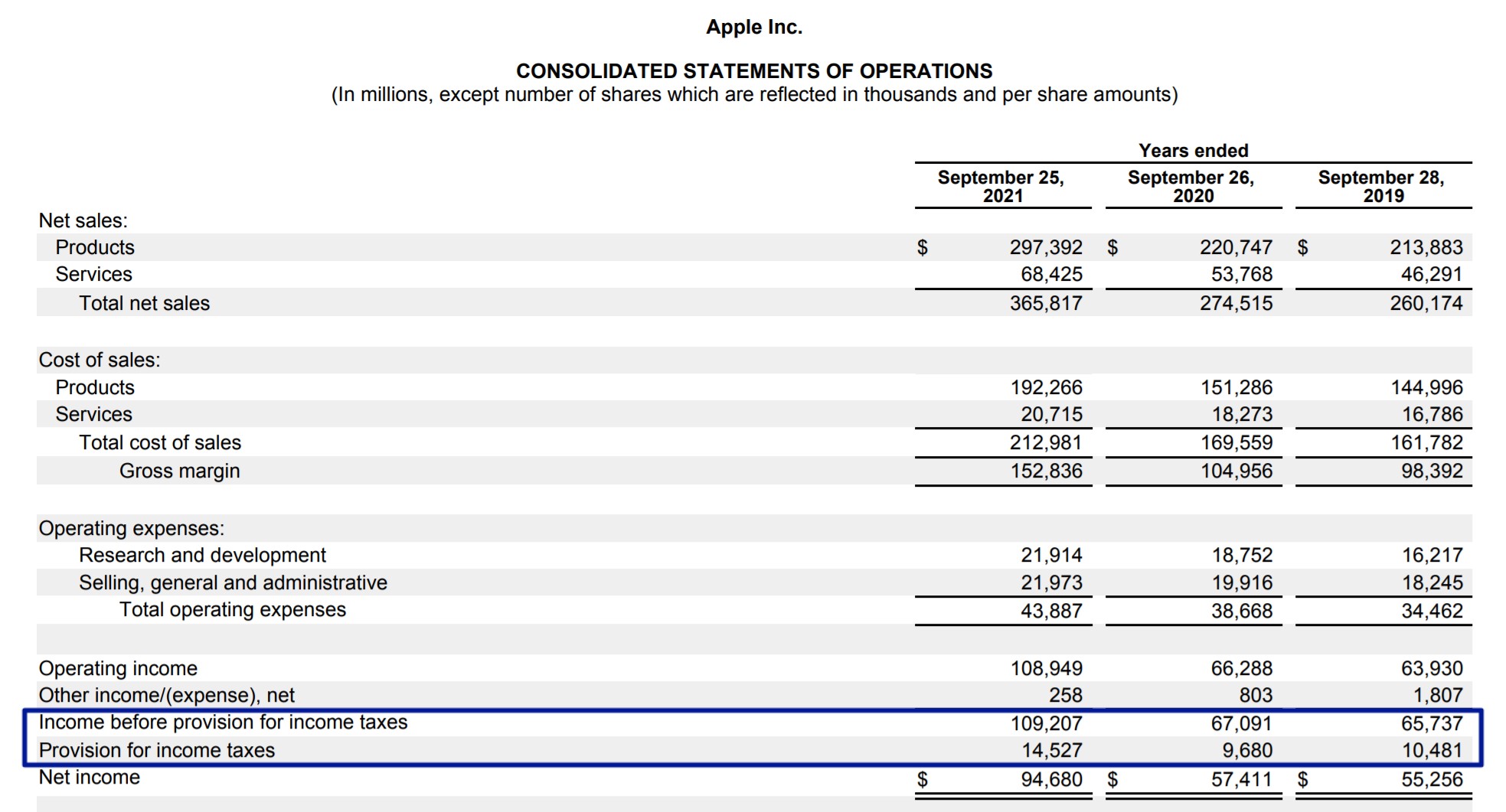

Effective Tax Rate Formula And Calculation Example

Tax Shield Formula Step By Step Calculation With Examples

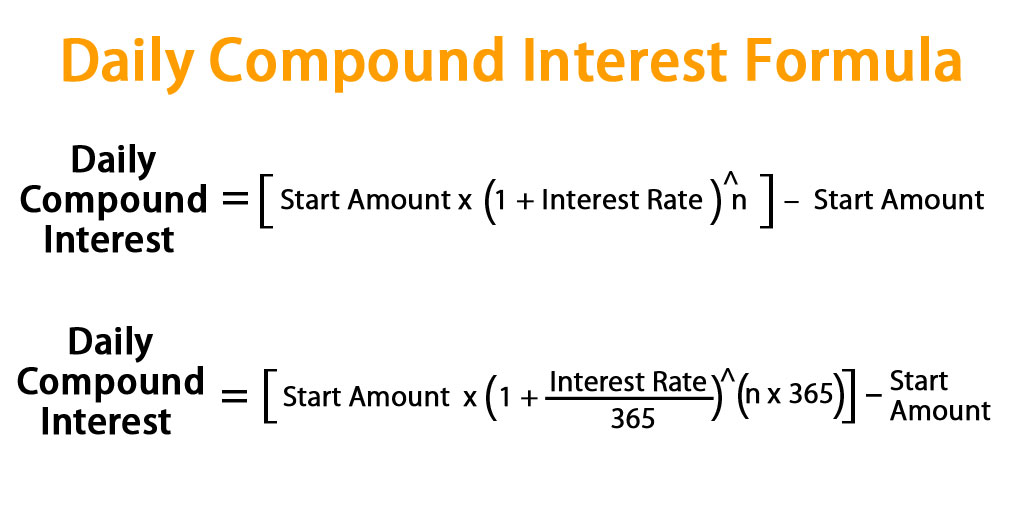

Daily Compound Interest Formula Calculator Excel Template

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

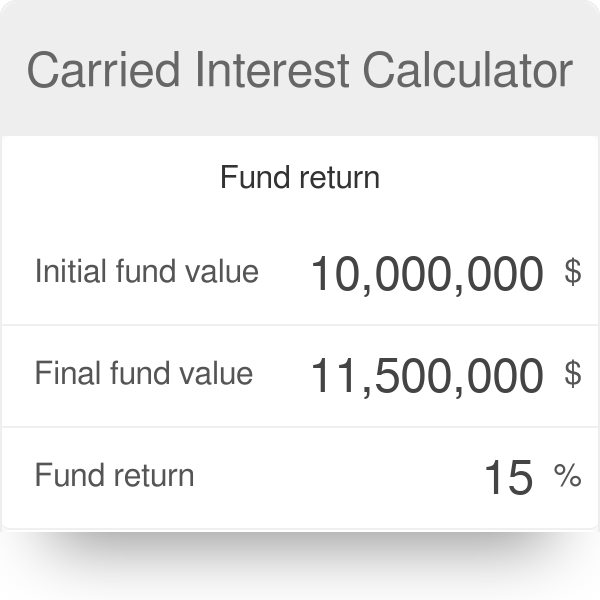

Carried Interest Calculator And Formula

Accrued Interest What It Is And How It S Calculated

Compound Interest Calculator Daily Monthly Quarterly Annual